Macquarie Infrastructure and Real Assets acquires additional stake in Gwynt y Môr Offshore Wind

Macquarie Infrastructure Corporation (MIC) owns, operates and invests in a diversified group of infrastructure businesses.Macquarie Infrastructure Corporation's business consists of the largest network of fixed-base operations in the United States, the largest bulk storage terminal business in the U.S., a gas production and distribution business, and a controlling interest in two district.

Private Funds Macquarie Infrastructure and Real Assets (MIRA) PDF Infrastructure Private

06 MIRA Infrastructure Sustainability Report 07. 02. For over 25 years, MIRA has partnered with clients, governments and communities to build and manage essential real assets that are used by over 100 million people every day. Our dedicated team of over 900 people focus on adding real and lasting value for our clients and the people our assets.

Macquarie Infrastructure’s green giant Magazine Real Assets

CEZ. Macquarie Infrastructure and Real Assets (MIRA), part of global financial services organisation Macquarie Group, said on Friday that a consortium led by Macquarie European Infrastructure Fund 6 (MEIF6) has reached an agreement to acquire power assets owned by Czech energy group CEZ in Romania. The integrated energy infrastructure portfolio.

Macquarie Infrastructure and Real Assets makes the Illion cut The Australian

About Macquarie Infrastructure and Real Assets. Macquarie Infrastructure and Real Assets (MIRA) is one of the world's leading alternative asset managers. For more than twenty-five years, MIRA has partnered with investors, governments and communities to manage, develop and enhance assets relied on by more than 100 million people each day..

Macquarie Infrastructure's Decisive Move To Create Shareholder Value (NYSEMIC) Seeking Alpha

Disclaimer. Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is an integrated asset manager across public and private markets offering a diverse range of capabilities, including real assets, real estate, credit, equities and multi-asset solutions. This information is a general description of Macquarie.

Macquarie capta 1.600 millones de euros para inversión en energía renovable El Periódico de la

Mar 21, 2024 - 12.46pm. For every Nick O'Kane poached from Macquarie Group, there are a couple of Grant Smiths. Smith, who heads up Macquarie's infrastructure and real assets investment.

Macquarie Asset Management closes sixth Americas infrastructure fund with 6.9bn in commitments

Macquarie Group Ltd's (MQG.AX) asset management division has raised $6.9 billion for its latest fund dedicated to investing in North American infrastructure, well over its $5 billion target, the.

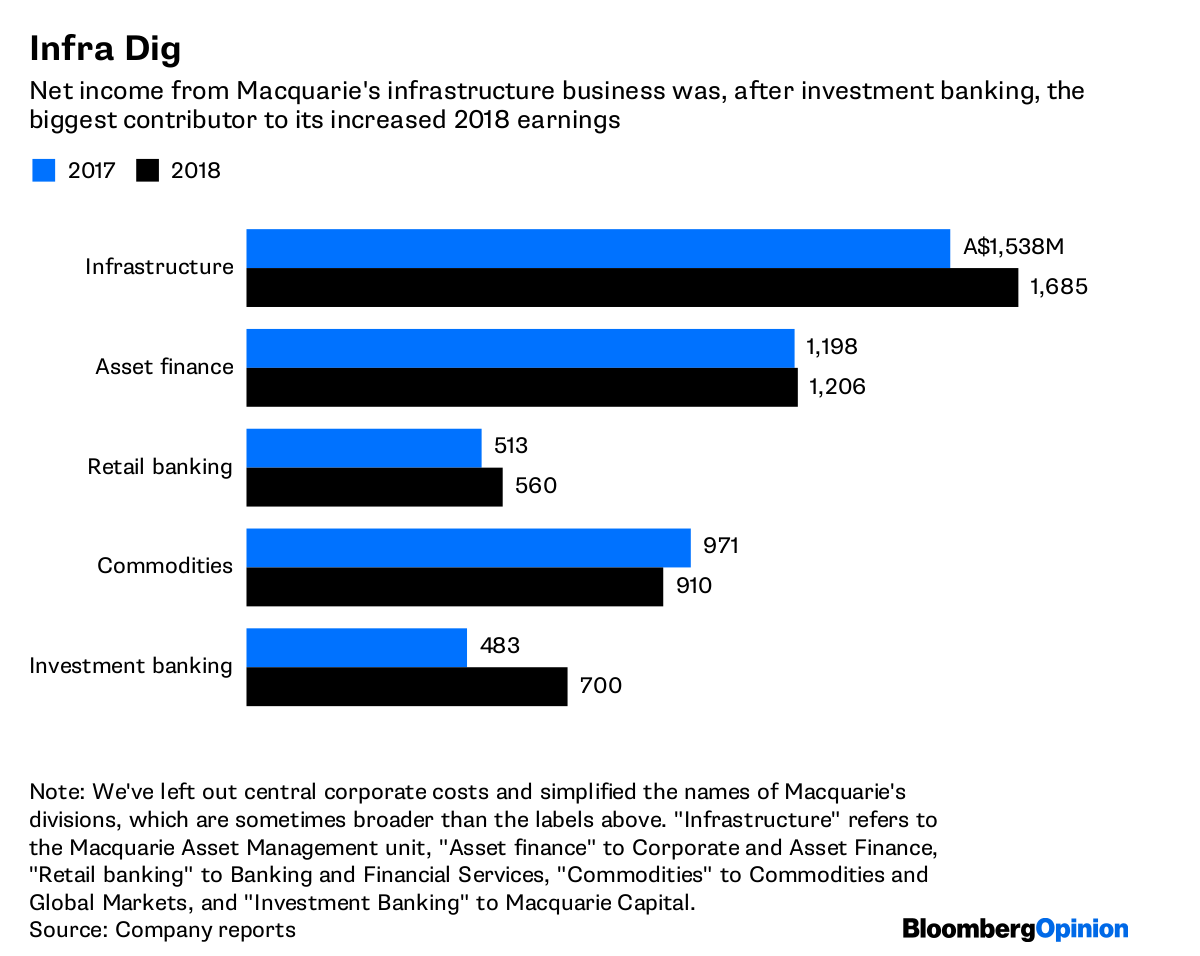

Macquarie Shows Infrastructure Can Love the Fed Bloomberg

Macquarie Infrastructure and Real Assets (MIRA) indicates that while investors clearly see the benefits and are increasing their ESG focus, some are still grappling with how to do so. This report outlines the key survey findings from 150 real asset investors

Deloitte România a asistat vânzarea a șapte subsidiare CEZ către Macquarie Infrastructure and

Macquarie Infrastructure and Real Asset:. MIRA specialises in alternative asset management, investing in and managing assets in infrastructure, real estate, agriculture, and energy sectors. MIRA's investment philosophy is based on creating long-term value for its investors, portfolio companies, communities, and the environment..

Macquarie Infrastructure and Real Assets in deal to buy Landgate The Australian

Macquarie Infrastructure and Real Assets has attracted more than €34 billion in commitments from investors over the past five years. Macquarie Infrastructure and Real Assets ("MIRA") today announced the final close of Macquarie Super Core Infrastructure Fund ("MSCIF") Series 1 with €2.5 billion committed by investors - exceeding.

PPT Macquarie NexGen Global Infrastructure Corporation PowerPoint Presentation ID4272948

Macquarie Group Limited (/ m ə ˈ k w ɔːr i /) is an Australian global financial services group. Headquartered and listed in Australia (ASX: MQG), Macquarie employs more than 20,000 staff in 34 markets, is the world's largest infrastructure asset manager and Australia's top ranked mergers and acquisitions adviser, with more than A$871 billion in assets under management.

James Hooke to retire as CEO of Macquarie Infrastructure Corp. News Institutional Real

Macquarie Infrastructure and Real Assets ("MIRA") has raised more than €1.6 billion for investment in renewable energy with the final close of Macquarie Green Investment Group Renewable Energy Fund 2 ("MGREF2") - exceeding its initial minimum fundraising target of €1 billion. MGREF2 is a 25-year closed-end fund which will invest.

Macquarie Infrastructure raises 3.1b

Macquarie Infrastructure and Real Assets (MIRA) and GLL Real Estate Partners have agreed to merge in a deal that will see the combined group managing €10.6bn of assets in Europe and the Americas. MIRA, which currently manages about €7bn assets in Europe, the Americas and South Korea, said it is buying the Munich-based real estate fund.

Macquarie Infrastructure and Real Assets PDF Investment Fund Investing

Macquarie Group. 554,000 followers. 3y. Macquarie Infrastructure and Real Assets has been named the No. 1 Infrastructure Manager by IPE Real Assets in its annual Infrastructure Investment Managers.

Macquarie Infrastructure and Real Assets' portfolio is relied on by more than 100 million people

Six months after closing on $ 850 million for its latest Asia Pacific opportunistic real estate fund , Macquarie Infrastructure and Real Assets is returning to Asia 's logistics market through a partnership with Tokyo-based developer Unified Industrial , according to a statement this week by the Australian fund manager . 1.

Macquarie Infrastructure Fund Invests In US Data Centre Netrality

Macquarie Infrastructure and Real Assets (MIRA), manager of the fund, said it had drawn investment from 32 institutions, including pension schemes, insurers and sovereign wealth funds, helping it.

.